Zinc prices were in decline for much of the first half of 2025 as primary supply increased and demand from the construction sector slumped.

Primarily used to make galvanized steel destined for construction and manufacturing sectors, zinc has come under fire in recent years as inflation and interest rates took their toll.

The metal performed relatively well in 2024 as weak supply was offset by soft demand. However, as 2024 began, new threats to its performance emerged as the US began to look to tariffs to correct perceived trade imbalances.

Market performance by the numbers

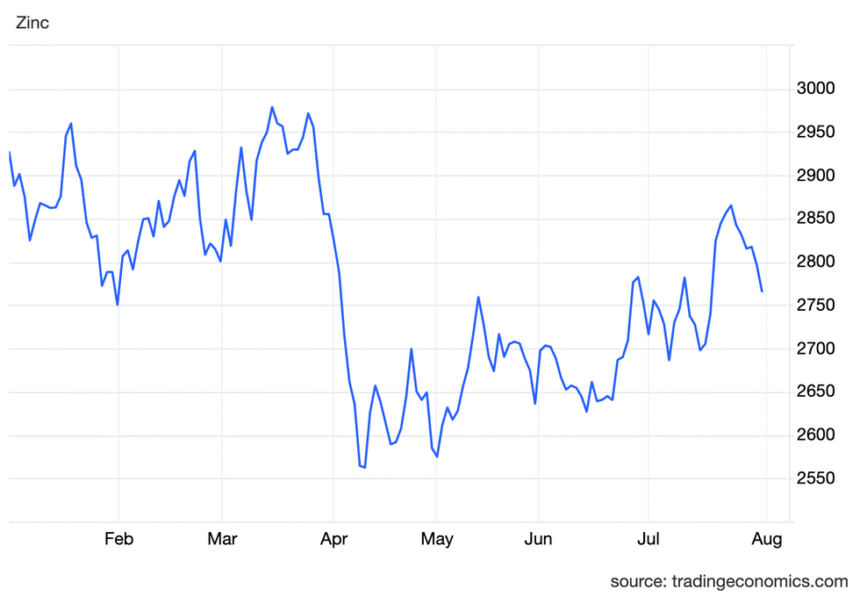

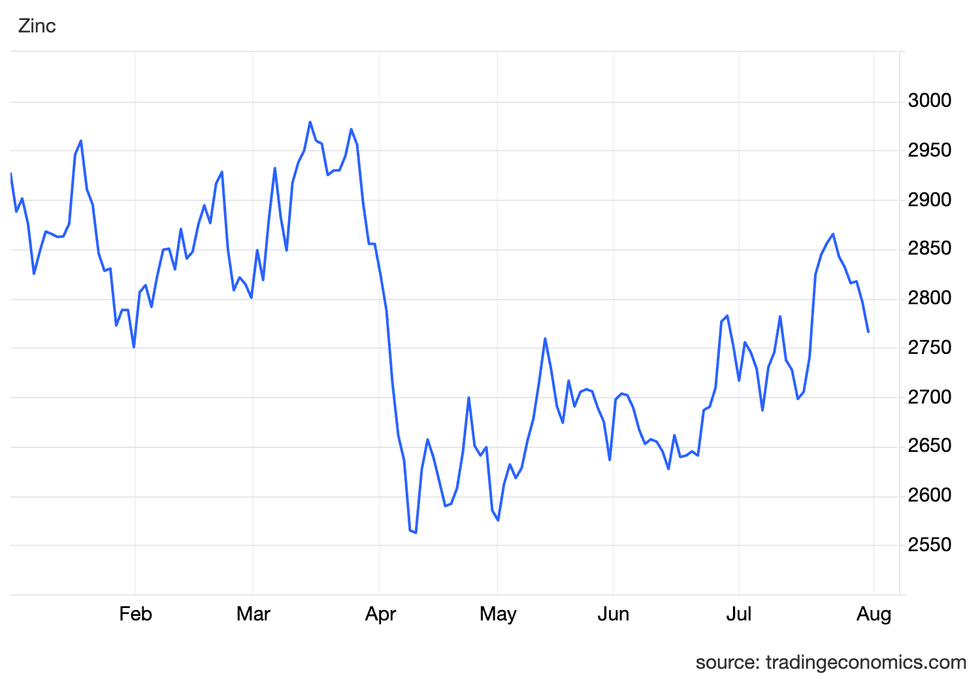

The zinc price started the year with downward momentum, sliding from US$3,150 per metric ton on December 10 to US$2,750 on January 31.

Zinc price chart, January 1 to July 31, 2025

via TradingEconomics

The metal found some support in February and March, climbing to US$2,928 on February 24 and then reaching a year-to-date high of US$2,971 on March 14; however, it wasn’t to last. The bottom fell out from under Zinc and quickly plunged to its year-to-date low of US$2,562 on April 9.

Since then, the zinc market has been volatile, and although it has recovered somewhat, it is still far from its first-quarter highs, peaking at US$2,865 on July 23.

What’s behind the price?

According to a review from the Shanghai Metal Market (SMM) on June 29, ex-China zinc concentrate production increased by 6.47 percent in the first quarter to 1.3 million metric tons versus 1.22 million metric tons during the same period of 2024.

It attributed these increases to resumption in production at Boliden’s Tara mine in Ireland, and ramp-ups at Grupo Mexico’s Buenavista mine in Mexico and Ivanhoe’s Kipushi mine in the Democratic Republic of the Congo.

Additionally, SMM noted that Xinjiang’s Huoshaoyun lead-zinc mine started production in May, with output reaching 50,000 metric tons in its first two months and is expected to reach 150,000 metric tons in July. The company is targeting full-year production of 700,000 to 750,000 metric tons.

Although supply seems robust and Chinese imports of concentrates increased 52.46 percent over 2024, treatment charges for imported metal have also increased from US$20 per metric ton at the start of the year to US$65 in May. The sharp increase in fees indicates an oversupply in the market, allowing smelters to charge more.

The SMM findings are further supported by data released from the International Lead and Zinc Study Group (ILZSG), which reported on June 18 that mining supply had increased during the first four months of the year to 3.94 million metric tons from 3.75 million metric tons in 2024.

It also showed flat demand for the metal with 4.28 million metric tons consumed during that period versus 4.3 million metric tons last year.

Changing US policy

A steep decline in commodity prices in April demonstrates just how fragile the global markets can be.

Zinc prices fell 13.77 percent at the start of April to US$2,562 per ton alongside President Trump’s “Liberation Day” tariff announcement and subsequent sell-off in the equity and US Treasury markets.

The prediction from analysts at the time was that if reciprocal tariffs were put in place, it would trigger a recession before the end of the year, impacting consumer spending on homes and cars, which have significant zinc inputs.

Demand for the metal has already been weak over the past several years due to high inflation and interest rates following the pandemic. Although inflation has eased, and interest rates have begun to normalize, the new tariff threat provides a new layer of uncertainty.

So far, auto makers have yet to raise their prices, but demand for new cars increased 2.5 percent in March, double the 1.1 percent typical for the same period in recent years. The gain is attributed to consumers looking to get ahead of more significant price increases down the line.

The impetus behind the tariffs is to stimulate domestic production, but the willingness from producers to follow through on new US projects remains uncertain.

For its part, the Trump administration has signalled its willingness to back large infrastructure and critical mineral projects by continuing the FAST-41 program that started under President Joe Biden.

The program aims to streamline the permitting process and speed development timelines to get the projects to production faster.

So far, the only zinc project to be included on the list is South32’s Hermosa, near Tucson, Arizona.

Progress at the site has continued with the company reporting in its update for the June quarter that it had made US$517 million in investments in FY25. It also stated that work on the main and ventilation shafts began during the second quarter, and construction work at the processing plant had begun.

In addition to development activities, the company also reported that it met a key milestone with the US Forest Service releasing a draft environmental impact statement.

The project is expected to see its first production from the Taylor deposit during the second half of 2027.

As a campaign promise, Trump proposed freeing up federal lands for housing projects, which could drive demand for galvanized steel products. The plan would invite developers to bid on land with the promise that a percentage of units would be set aside for affordable housing, and close the 4 million home shortfall.

However, a report from Realtor.com on July 22 poured cold water on the idea, stating that while it could offer incremental gains, it noted that there wasn’t enough land in places that need housing most.

Instead, the report suggested there are better methods available, including land use and zoning reforms, and increasing construction capacity in high-demand regions.

So where does that leave zinc?

With supply surpluses expected from the ILZSG, a significant turnaround may not be in the cards for zinc prices in the short term, especially when met by weak demand due to tariff uncertainty.

Although there was some recovery at the end of the second quarter, the oversupply situation doesn’t lend much support for the market to turn bullish.

The market has largely seen a dearth of investment as the market fundamentals haven’t provided support.

A June 11 report from analysts with German investment bank, IKB, noted the oversupply situation developing in the Zinc market and forecast that by the end of the third quarter, zinc prices will be trading in the US$2,600 per ton range.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

From Your Site Articles

Related Articles Around the Web